Understanding the FinTech Transformation: A Brief History

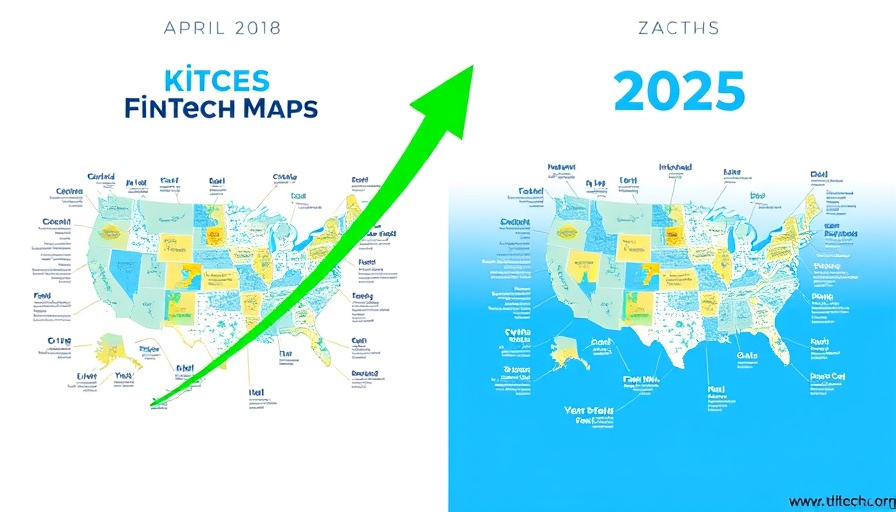

The FinTech landscape has seen rapid transformation over the past decade, driven by technological advancements and a shift in consumer expectations. Michael Kitces first ventured into this dynamic world with the launch of his "Financial Advisor FinTech Solutions Map" in April 2018. At that time, the map showcased 189 fintech companies across 29 distinct categories, serving as a vital tool for financial advisors and firms seeking to navigate their technology needs. Fast forward to 2025, and we see a staggering evolution where the map now encompasses 551 companies organized into 36 categories. This substantial growth reflects not just the expansion of the industry but also the burgeoning complexity and necessity of tech solutions in wealth management.

The Key Areas of Technological Demand in Wealth Management

The current landscape, segmented into five core buckets—financial planning, investment management, client engagement, business development, and operations—highlights where firms see the greatest technological impact. Investment management ranks as the most populated segment with 164 firms dedicated to various aspects such as portfolio management and risk assessment. Operations follow closely with 120 solutions aimed at enhancing efficiency through automation. With growing categories like client engagement tools and business intelligence software, the emphasis on technology's role in enhancing client relationships becomes apparent.

The Emergence of New Solutions

Against the backdrop of established categories, new solutions are popping up to meet emerging needs. The map not only showcases old trusty CRMs, which have evolved significantly, but also introduces innovative platforms that leverage artificial intelligence and big data. For instance, portfolio management systems on the map have surged to 33, illustrating the intense competition and diverse offerings available in today’s market. This proliferation signifies that as firms hone in on technology adoption, they are increasingly investing in specialized solutions to deal with unique challenges they face.

Focusing on Growth Amid Global Challenges

The financial industry is also not immune to external pressures, such as regulatory changes and economic fluctuations. Yet, despite the challenges brought on by global events, the investment in fintech solutions continues to see upward trends. Financial firms are recognizing that embracing technological advancements is critical not just for growth but for survival in an increasingly competitive environment. The need to optimize operations and ensure compliance is vital now more than ever.

Navigating an Overflowing Marketplace

In today’s marketplace, advisors face the paradox of choice. With extensive options in various categories—such as the 26 CRM systems listed by Kitces—how do firms select the right platform? This article aims to demystify that selection process, offering insights on which factors should influence decision-making. Understanding specific needs, such as the size of the firm and the customer base, becomes crucial. Additionally, firms must evaluate the interoperability of these chosen tools to create a cohesive tech ecosystem.

Practical Tips for Leveraging the FinTech Map

As the Kitces FinTech Map continues to evolve, it serves not only as a roadmap but as a starting point for financial firms aiming to enhance their tech strategy. Here are key actions to consider: 1) Regularly assess your technology stack to identify gaps; 2) Stay informed about new entries within the map; and 3) Engage with vendors for demos to understand how their solutions can complement your existing processes.

Final Thoughts: The Future of Wealth Management Technology

The growth of the Kitces FinTech Map illustrates a crucial trend in wealth management—the undeniable reliance on technology for operational efficiency and enhanced client engagement. Technology is no longer a mere tool but a fundamental pillar of a modern advisory firm. As we move forward, embracing these technological solutions will be vital for firms striving for innovation and success in a rapidly evolving landscape. It's time for every financial professional to reevaluate their tech's potential. Are you geared up for the future?

Add Row

Add Row  Add

Add

Add Row

Add Row  Add

Add

Write A Comment